Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Author: Steven Scheer

JERUSALEM (Reuters) – State-owned Israel Aerospace Industries is ready for an initial public offering in Tel Aviv but is awaiting the green light from the government, IAI CEO Boaz Levi said on Sunday.

A ministerial privatization committee in November 2020 approved a plan that would see Israel sell up to 49 percent of IAI, the country’s largest defense firm, on the Tel Aviv Stock Exchange, bringing in billions of shekels.

“We are moving towards an IPO,” Levy said at a TASE investor conference. “In the past year, our business results continued the growth trend of IAI.” We are currently experiencing phenomenal performance.”

He said that according to a government decision that has already been approved, an IPO of a minority stake in IAI will take place as soon as the finance and defense ministries “decide that it is time to do it.”

Those ministries declined to comment.

Israeli media reported that the need to reach an understanding with the IAI union and weakness in the stock market over the past two years led to the suspension of the IPO.

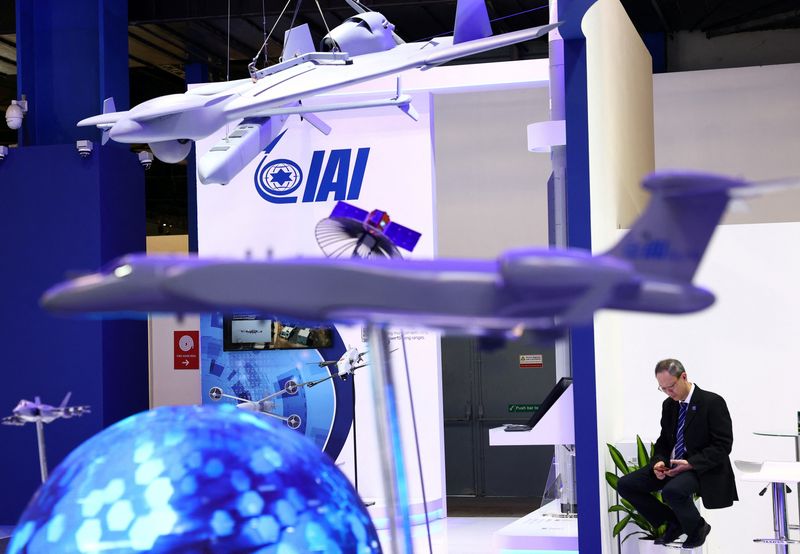

IAI manufactures defense and civilian products including aircraft, air and missile defense, unmanned aerial systems (UAS), ground robotics, precision-guided weapons, munitions, satellites and systems for space activities.

During the first nine months of 2024, IAI posted a record profit of $416 million, up 74% year over year.

Sales rose 13% to $4.4 billion amid an increase in military conflict on multiple fronts in the country, while IAI’s order backlog rose more than $7 billion over the past year to $25 billion at the end of September.

It has 156 million shekels ($43 million) of bonds traded on the TASE.

In June, IAI paid a $155 million dividend to the Israeli government.

(1 USD = 3.5995 shekels)